The problem

If you’re trying to decide where to go for dinner, you can easily compare restaurant expensiveness online. Inexpensive restaurants are usually designated with one dollar sign, while expensive restaurants have three or four.

But if you need to get care at a hospital, how can you know which are the most and least affordable? Depending on where you live, you could have a handful or dozens of choices—and until now, there was no way to see which are generally expensive, inexpensive, or average.

The solution

Amino users now have access to Amino’s Facility Imaging Cost Rating. These are cost ratings designed to rate the relative expensiveness of imaging facilities where you can get MRIs, X-rays, CT Scans, and more. The Facility Imaging Cost Rating is an easy to understand, symbolic system of dollar signs ranging from one dollar sign  denoting “inexpensive” to four dollar signs

denoting “inexpensive” to four dollar signs  denoting “expensive.” It appears on the profiles of imaging facilities (including hospital-based imaging and freestanding imaging centers).

denoting “expensive.” It appears on the profiles of imaging facilities (including hospital-based imaging and freestanding imaging centers).

This makes it easy to compare imaging facilities by relative costliness. At a high level, you can see which are most expensive, which are least expensive, and which are just about average. You can also add your health insurance carrier to see a dollar sign specific to your insurance. By default, your imaging search results will be sorted with Smart Matches first.

Amino’s Facility Imaging Cost Rating is built on the Amino Facility Imaging Cost Index, which allows us to measure the expensiveness of any given imaging facility based on outpatient fee-for-service procedures. Currently, nearly 16,000 facilities have an imaging cost index and therefore a Facility Imaging Cost Rating. Facilities that lack a cost index—and therefore do not have a Facility Imaging Cost Rating—get an “N/A” symbol that looks like this: ![]()

Algorithm design

To develop the Facility Imaging Cost Index, we compare costs of services for different combinations of facilities and insurance payers. Amino’s data includes about 35,000 facilities, 125 insurance payers and 6,500 procedures. This amounts to 3.5M cost observations since the beginning of 2016 from over 100,000 combinations of facilities and payers. For outpatient imaging services, our data shows that costs tend to be proportional—i.e., if a facility is more expensive than another for one service, it is also expensive for a different service. In fact, it is more expensive by the same proportion. Consider a hypothetical example of two facilities A and B. We can compare the costs of two specific procedures for a private insurance payer:

| Facility A | Facility B | |

| Service X | $20 | $25 |

| Service Y | $140 | $175 |

| Cost Index | 2 | 2.5 |

For procedure X, Facility B charges 1.25x more than Facility A. The same is true for a different Service Y. We could say Facility B is 1.25 times expensive than Facility A. So if Facility A is assigned cost index of 2, we want to assign Facility B a cost index of 2.5. Note that the cost indices for the same facility could be different for a different payer. We use the costs observed for one of the major payers across facilities as the baseline for costs, and compute cost indices for different facility payer combinations as multipliers on top of those baseline costs. This approach adjusts for variation in costs due to location.

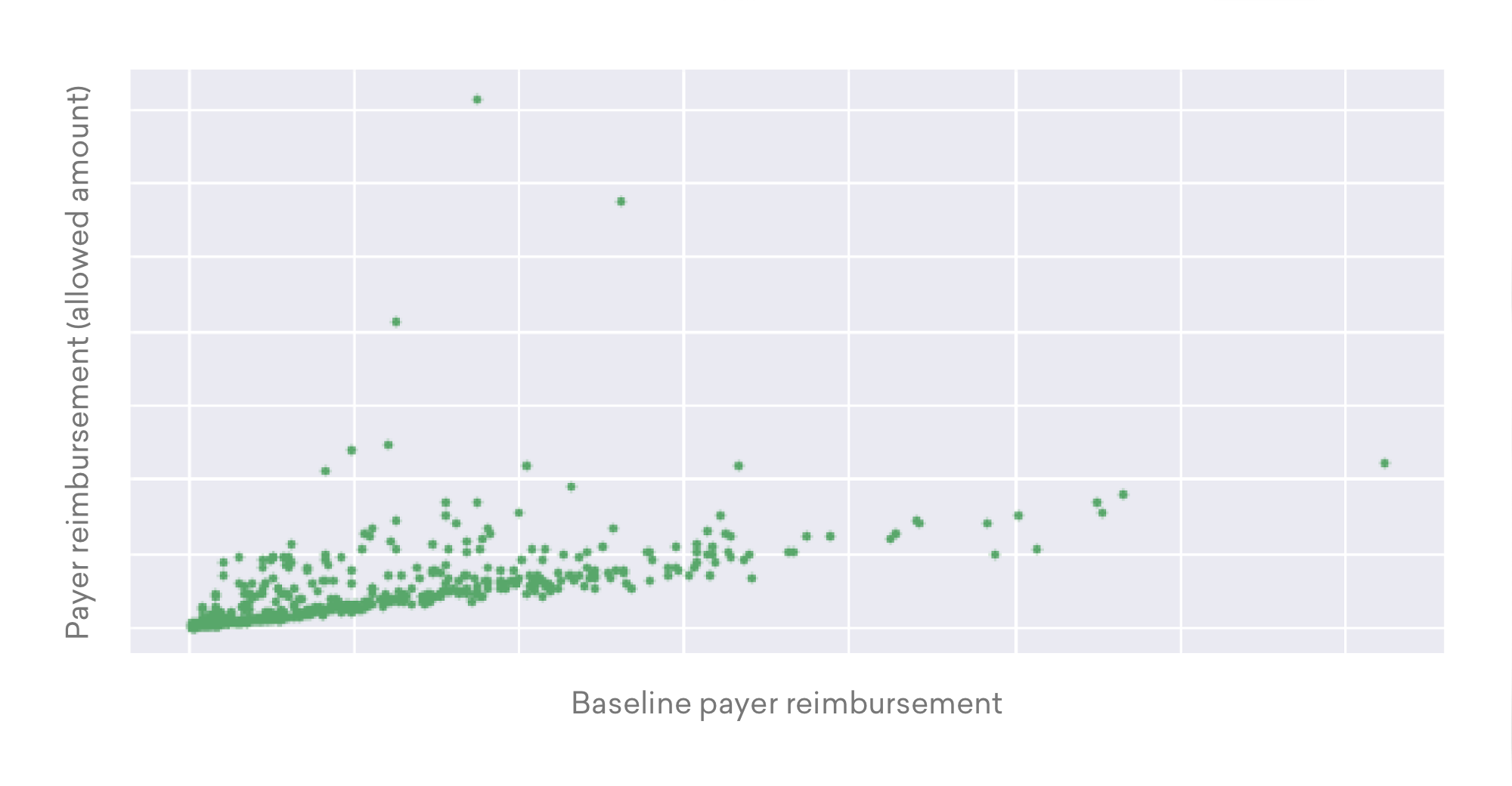

Below is a real data sample comparing outpatient costs observed at a facility for a private insurance payer and the baseline.

From the plot, you can see a linear relationship between the two payers. The slope of this line reflects the cost index that we calculate for that facility-payer combination.

In reality, healthcare contracts are very complex and depend on a variety of factors including provider, payer, facility type, facility location, procedure, patient diagnosis, and so on. Our goal is to find a significant enough pattern in the prices across facilities so that we can order facilities by expensiveness. We believe that estimating multipliers using outpatient imaging procedures across facility and payer combinations serves this purpose.

Once we have the cost indices, we calculate the national average of all cost indices across all private insurance payers and a national average cost index for each payer. Next we compare each facility’s payer cost index to the national average cost index in order to determine its relative expensiveness.

Facilities that charge near the national average cost index receive two dollar signs. For example, if the national average cost index for Acme Insurance Co. is 3x, all facilities with cost indices near 3x will receive two dollar signs ![]() when that payer is specified.

when that payer is specified.

Facilities that have less than the national average cost index will range from 1 dollar sign  to 1.5 dollar signs

to 1.5 dollar signs ![]() . Facilities which have more than the national average cost index will range from 2.5 dollar signs up to 4 dollar signs.

. Facilities which have more than the national average cost index will range from 2.5 dollar signs up to 4 dollar signs.

When we don’t have enough confidence to produce an Imaging Facility Cost Index, we create a normalized index based on related information about the facility and their pricing patterns or facility type. We then take these indices and map them to dollar sign ratings to rank facilities by relative expensiveness.

We also consider that different facility types price imaging differently — freestanding imaging centers are commonly a cheaper option than hospitals.

If you don’t specify a payer (aka your insurance), you’ll see an average rating across all payers for that facility. To produce this “all-payer rating,” we first take the existing cost indices for all payers associated with that facility and calculate the average (this is the “all-payer” cost index). Then we take the all-payer cost indices for all facilities and run the same calculation as we would for a specific payer—comparing the facility’s “all-payer” cost index with the national average cost index to produce the “all-payer” cost rating.

Here’s how the distribution breaks down for all-payer cost ratings.

| Dollar Signs | Standard deviations | Share of facilities with this dollar sign |

| 1.0 |

Less than -0.50 | 20.3% |

| 1.5 |

-0.50 | 32.0% |

| 2.0 |

-0.25 | 22.3% |

| 2.5 |

0.10 | 11.2% |

| 3.0 |

0.50 | 6.3% |

| 3.5 |

1.00 | 3.2% |

| 4.0 |

1.50 | 4.7% |

You may also see a callout below the dollar signs that says how much below or above the national average any specific facility costs. This is calculated by averaging all facilities in our database for a specific payer (or in the case of all-payers, we average the average). The calculation for producing “% below average cost” is:

(facility cost index / national average cost index - 1)

Have any questions or wish to enquire further about our methodology or database? Contact us at feedback@amino.com